Almost every route to higher revenues depends on a reliable and predictable supply chain. When asked about whether their supply chains meet these standards, most company executives answer “no”. Whether you are the CEO, CFO or the Supply Chain Director, knowing that your supply chain weaknesses could suddenly derail this quarter’s numbers, keeps you awake at night! If 2020/21 has taught us anything it is that managing long term risk, sustainability considerations and the financial impact of an inefficient supply chain, can make the difference between enterprise success and failure.

Topics: Disruptive Procurement, Working capital improvement, Cash Flow

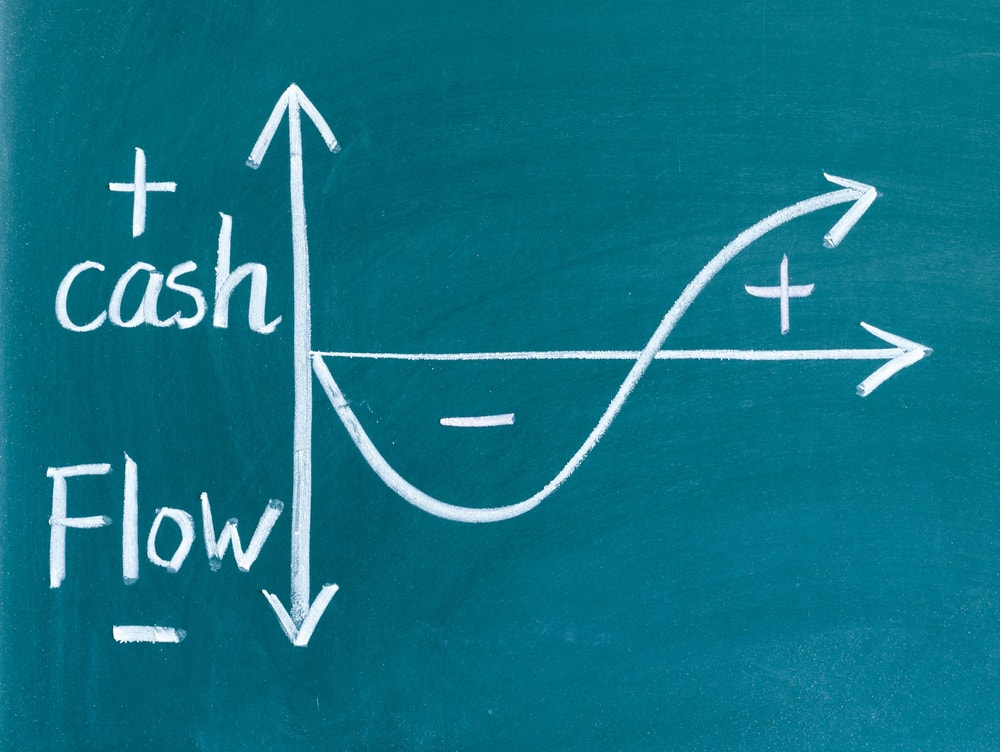

There are few things more consistent in business than the rule that companies need cash to grow. Cash is far more important than profit in the short term so working capital deserves special attention. Pretty much all businesses who have survived the pandemic now meet the definition of “growth business” and are now caught in the cash paradox. Whether 2020/21 was a historic year because Covid boosted sales or you saw a big dip below previous levels from which a rebound is expected – the story of 2021-22 will centre around growth.

Topics: Disruptive Procurement, Working capital improvement, Cash Flow

The pandemic and Brexit together represent a shock of unprecedented proportions that have transformed the economy and changed priorities. I’ve begun to run out of superlatives to describe the scale of the upheaval we have all experienced in the last year. Manufacturing and construction have certainly fared better than some parts of the economy like retail and hospitality, but we are beginning to see the shoots of recovery everywhere. Now is the time to take a hard look at your supply chain and to create value. In my long experience, most companies underestimate this opportunity by as much as 50%. And the value can be delivered in as little as 90 days! Our new research featured in UK Manufacturing Barometer clearly demonstrates some of the issues you need to face into.

Topics: Supply Chain Management, Working capital improvement

The team at Insider Pro have researched 1,500 UK manufacturers and found a worrying pre Brexit, pre-Covid picture. Although in the last 5 years UK manufacturers grew sales by 21%, they failed to grow profits.

In the same time frame;

- Collection of debts improved by 3 days

- They failed to secure longer credit terms from suppliers

- Stock bloated from 55 days to 61!

As the effects of Brexit wash through, and companies try to reboot volumes in 2021, there is trouble on the horizon. Profits are set to halve and cash is under pressure like never before! But there is also good news. The winners in the next 18/24 months will be those who win the battle for cash. With strong cash controls, companies can build a war chest which will help them win market share and invest where their competitors can't. Supported by a robust, agile supply chain, the winners may well take it all. The stage is set for disruption and change.

As we edge towards re-igniting the economy, CFOs of large, medium and small enterprises, need to focus on the basics. The old mantra "Cash is king" has never been more important if companies are to recover and take advantage of the new normal.

Topics: Disruptive Procurement, Supply Chain Management, Enterprise Value, Working capital improvement

If 2020 has taught us one thing, it's the importance of team spirit. And Insider Pro demonstrated this clearly at our Christmas jumper charity event last week. Since March, everyone has been forced into a position of uncertainty and isolation and being part of a team has become even more important. It was critical to decide quickly on the best ways to hold the team together, communicate, connect and maintain important relationships.

Topics: Best Practice, Our Team

On 5th December 2018, we published a blog https://blog.insiderpro.co.uk/7-things-to-do-now-to-prepare-your-supply-chain-for-brexit

It's time to re-visit and assess whether those 7 things are still relevant today. Now, exactly two years on, UK and European businesses await final the Brexit terms, amidst dramatic newspaper headlines which talk about a deal "hanging in the balance" and threat of "catastrophe at the borders". Meanwhile, professionals in industry continue to assess the potential impact on their supply chains across the continent.

Topics: Supply Chain Management

Companies that have surpassed the £20m turnover mark have already worked hard to structure their business in a way that maximises business growth and the value of their enterprise;

They’ve been focused on driving sales

They've negotiated costs to the best of their ability

They’ve reviewed and optimised their operational processes.

In short, they’ve already examined each area of the business.

Yet many CEO’s and investors that I speak to know that they could do even better. They’re just not sure how.

Topics: Procurement Consultancy, Enterprise Value

One of the most common questions I am asked by CFO's and Financial Controllers is; "How much can we improve EBITDA from our supply chain?" My answer, is always the same; "More than you think. Probably about double."

Topics: Enterprise Value

In economies like these, growing the business and its enterprise value can be challenging. In fact, it’s always challenging!

Increasing EBITDA and the multiples needed to increase company value, requires a laser-like focus on certain high-impact levers available to you.

As a Finance Leader, an Executive or Business Owner, you have many stakeholders to keep happy and challenging targets to meet. As the conscience and steward of the business no doubt, you will face questions around:-

Topics: Enterprise Value