There are few things more consistent in business than the rule that companies need cash to grow. Cash is far more important than profit in the short term so working capital deserves special attention. Pretty much all businesses who have survived the pandemic now meet the definition of “growth business” and are now caught in the cash paradox. Whether 2020/21 was a historic year because Covid boosted sales or you saw a big dip below previous levels from which a rebound is expected – the story of 2021-22 will centre around growth.

This principle applies to all businesses, large and small and across all sectors. Insider Pro’s recent original research focused on the UK Manufacturing sector and on small and mid-sized companies with annual revenues between £50m and £1,000m. However, the findings and learnings are relevant more widely, in construction, distribution, healthcare, retail and hospitality, especially as businesses come out of the lockdown period and begin to experience recovery and growth.We see three main areas of focus which can make the difference between a great year and a grim one.

- Manage cash across the supply chain

It is quite common for businesses to be profitable but unable to generate cash. Equally a loss-making company may have no difficulty with cash flow for a period of time. This conundrum simply relates to the fact that, though profit intuitively makes sense as a concept, it is more artificial than cash flow – to assess profitability, cost items are recognised not when they are paid for, but in terms of how they relate to a company’s operations. This is most obvious with big-ticket items like factory machinery – buying a new piece of equipment causes an immediate outflow of cash, but profits are calculated by spreading that expense over the useful life of the machine. Over the longer term, cash flow and profit should roughly even out, but in the short term, a cash-flow shortage can break a company. It is surprisingly common for increased sales to create cash-flow problems because companies have to fund rising production before they collect the revenues generated.

- Understand why Working capital matters

Working capital deserves special attention. At its simplest, it describes the cash tied up in raw materials, work-in-progress and finished goods, collectively known as inventory or stock, plus the unpaid invoices owed by customers, less the amount owed to suppliers. Cash in the bank is usually included too, whether its funded by loans or not, but it is the non-cash components which can obviously cause a liquidity crunch.

Maintaining adequate stocks of raw materials, processing them, and keeping enough inventory of the finished goods to cope with variable demand all tie up cash and need funding. There also has to be enough cash to keep the company going (paying staff, keeping the lights on) while a company is waiting for customers to pay for goods they have received, and there is an art in finessing how long a company can delay paying its suppliers without damaging its relationships or rupturing its supply chain. The Small Business Commissioner has acquired extra powers to clamp down on late-payment practices by large customers but depending where a company sits in the supply chain this can be a double-edged sword.

The more complex the supply chain, the more difficult managing working capital becomes. For example, if a company is supplying parts to a just-in-time car manufacturer, it has to be extremely responsive to the needs of its customer and attempt to fine-tune its own working capital accordingly. Meanwhile, manufacturers of seasonal products usually need to stockpile them, using cash from the peak sales period to fund operations through the low season. Equally, very powerful buyers (like supermarkets for example) are extremely adept not just at squeezing producers’ prices, but more importantly for cash flow, they are notoriously slow payers too. International supply chains come with all the added complexity of longer transportation, customs-related delays and bureaucracy.

- Get the whole Team to focus on 3 key challenges

We see many companies where the senior team are working in silos and do not communicate or coordinate effectively. They are not generally focussed on cash flow or working capital and yet, their day-to-day decisions and actions can have a huge effect on these key financial metrics. If you can communicate these three areas and increase focus, there will be improvement.

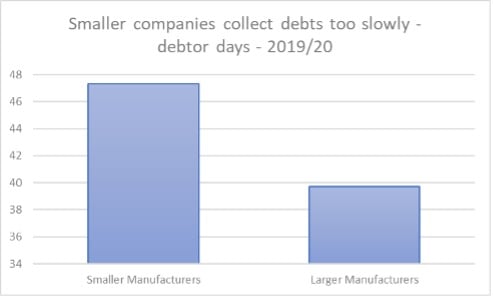

Challenge 1 – getting paid

Source: UK Manufacturing Barometer Edition 1

Collection of customer debts should be done as swiftly as possible. During the interval between supplying goods to customers and collecting the cash, companies are effectively financing their customers, allowing them to sell on the goods or add further value before actually paying for them. In the graphs shown above, most manufacturing sectors have improved collections, but bigger players are consistently significantly more effective than their smaller counterparts. Those with sales under £200m give their customers an extra week to pay on average (47.3 days compared to 39.7 days for larger producers). For almost the same value of sales in 2019/20 the smaller companies in our sample provided their customers with £2.6bn more credit than bigger firms. On average customers owed each smaller company £12.2m in 2019/20 at any given moment, compared to outstanding invoices of £38.5m for larger firms.

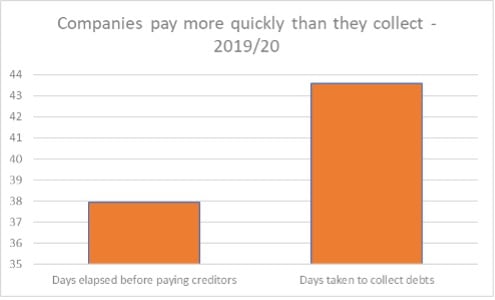

Challenge 2 – holding off creditors

Source: UK Manufacturing Barometer Edition 1

The second challenge is to delay paying suppliers as long as possible. A company must strive to complete as much of the production and sales process as possible before they have to pay suppliers. In other words, suppliers cane help finance a producer’s working capital.

Overall, manufacturers are subject to tighter payment terms from their suppliers than they extract from their customers, paying their bills on average almost six days more quickly than their customers settle their accounts. The average company in our sample was owed £5.6m more by customers than it owed suppliers at any given moment in 2019/20, up from £4.9m in 2015/16. Even if debts were collected and creditors paid at the same time, the difference between the two would always grow if sales are increasing, because a manufacturer is adding value in his production process – selling products for more than the cost of raw materials. Taken to its logical conclusion, too much growth and the company simply runs out of cash to operate, meaning constant vigilance is essential.

Challenge 3 – stock control is crucial

The final challenge relates to inventory management. This can be especially difficult. Manufacturers need enough raw materials to keep production going, but having too much not only adds cost in terms of warehousing and can lead to spoilage in some industries, but this also absorbs huge amounts of cash. Equally companies do not want capital tied up in goods mid-production, nor in finished goods sitting waiting for customers to buy them.

Source: UK Manufacturing Barometer Edition 1

Strong communication across functional teams is critical. Insider Pro forms the bridge between Finance, Operations and Supply Chain, providing the CFO with greater visibility and a disruptive approach to leveraging sustainable opportunities within the supply chain.

Download our report now for further insight and arrange a call to discuss how we could support your team to improve cash flow, working capital and stock management.