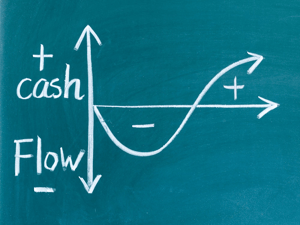

As we edge towards re-igniting the economy, CFOs of large, medium and small enterprises, need to focus on the basics. The old mantra "Cash is king" has never been more important if companies are to recover and take advantage of the new normal.

During the pandemic, many companies acted out of instinct to protect their staff. They tried to protect jobs, borrow under CBIL’s or similar schemes and used furlough to avoiding stripping capacity. But for all but the lucky few, the inevitable happened. The pandemic soaked up hard won cash reserves. Now, as the vaccine roll out moves us inexorably towards an open economy, operating cash will be tested like never before.

In the euphoria of re-opening, it is easy to forget one of the first rules of business. Growth burns cash. And given that many organisations are now ramping up their output versus last year up from a significantly dented financial position, the race for cash will define who wins and who stalls out. The winners will be the those who can capitalise on pent up demand, meeting the needs of customers where their competitors fail, gaining market share and building enterprise value.

The danger is that outside of the finance team, managers revert back to their traditional focus on profitability and in doing so miss the need to generate enough month-to-month cash to keep people employed and pay the bills. Sectors with long cash conversion cycles or delinquent debt will suffer more than others but the double whammy of implementing new Brexit processes and recovering from the pandemic will affect everyone.

So, what can you do to create CASH... NOW....FAST? Procrastination is the enemy in this climate. Get planning now to make avoid unpleasant surprises and take advantage of the turmoil that a fast growth summer will bring.

Spending budgets for 2021 have most likely been approved and might include some increases for inflation and planned activity. Each functional team has been challenged to find savings but do you have confidence that these will be realised or deliver tangible benefit to the bottom line? The truth is you probably cannot see where the acceleration of badly needed cash is going to come from.

A deeper look into your supply chain can help. Here are 5 ideas on where to look for cash, how to get teams focussed on the importance of cash creation and how to deliver the changes that will make impact in 90 days:

1. Talk to your supply chain - most third-party suppliers, like your business, want to keep their ship afloat and maintain a base of business ready for when things get better so you’ll find a receptive audience. Explore how you can help each other - this might involve looking at payment terms, or contractual elements such as rebate schemes, fixed pricing and discounts. The circumstances in the next few months for your suppliers will be different from when you originally hired them and from whatever interim arrangements you had during lockdown so be prepared for surprises. Not all surprises will be unpleasant. We have already seen many companies who have emerged fitter and stronger from 2020 and are keen to help out customers who they see as a good bet for growth. For example; if you purchase assets but are experiencing a higher cost of capital than usual, does leasing now make sense?

2. Collaborate with your customers, suppliers and partners - Businesses typically develop the way they work organically. This is especially true within the operational interface i.e. where your company works with outside organisations. From our experience of over 100 companies, we almost universally see better, more disruptive or efficient ways of working together which cut out cost or speed up activity. Most of which can be implemented in 90 days and can throw off cash just as quickly. For example, if you are a B2B business, try to work with your customers so they can better serve their end customer by providing more accurate production forecasts. Or share a logistics hub with a non-competitive business. You don’t need to collaborate with everyone (we suggest you don’t try!) but most businesses can find 3-5 quality collaborations which can make a difference.

3. Review your cash conversion cycle processes - It is rare that processes are optimally efficient. There is always room for improvement largely because the world is constantly changing, and it is impossible to keep up. However, the pressures of 2020 and the pressure which will come in the ramp up, demands that you review any process that materially affects cash now. Where can you speed up and simplify? Are your KPI’s and supporting data good enough? How accurate is your forecasting? Does anyone actually see the numbers and use them to make decisions? You’d be surprised how many businesses leave millions of potential cashflow on the table because the day to day decision makers within the business can’t see, or don’t understand cash.

4. Focus on "next" practice rather than "best" practice - We would all love to play the perfect game, but real-life business is scrappy and many CEOs, CFOs and senior managers feel they fall short of where they would like to be. Don’t let this put you off. As British Cycling proved under Dave Brailsford, margin gains win world titles. Lots of small improvements and some disruptive procurement are easier to execute, create cash quickly (often within weeks) and quickly build momentum that you’ll see in your accounts. What impact would a 1% reduction in COGS and overhead, a 1 day improvement in fulfilment time and a 1% reduction in inventory do for your annual cashflow? And how would you invest this to make 2022 and beyond, landmark years?

5. Talk to your people - Ultimately it's all about Hearts and Minds. Does everyone really understand the levers they can pull to create cash? You'll be surprised how people become indoctrinated over the years with concepts they are familiar with, such as gross margin measurement, but do not fully realise the impact they can have on cash generation or lack of! Simple explanation to get everyone on the same page can make a huge impact, and quickly.

"Cash is King" and there are many ways to generate it faster than you think. Now is the time to start looking and make it happen.

If you would like to talk through some ideas, hear about some case study examples or simply ask questions, please click above and I will be pleased to chat.