The Vital Role of Supply Chain and Operations: Lessons from a leading UK Firm.

A couple of weeks ago I wrote about “Looking under the hood”. Here is a great example of what I mean. At Insider Pro, we see the pattern time and time again - long-term, legacy contracts that were initially great value for the customer but, over time, the supplier has managed to push through incremental price increases, or adjusted clauses that are not in the customers' favour.

Topics: Supply Chain Management, Contracts

This blog post provides a very different insight from the usual blog posts we produce at Insider Pro, rather this post is more personal about my two years at the company. Working at Insider Pro was my first ‘proper’ job post-university and so as you can imagine, I have experienced a plethora of things in this time.

I finished University in September 2021 and was presented with the opportunity to join a professional cycling team. Cycling has been a passion of mine from a young age and I knew this was an opportunity I should not turn down. Accepting this meant that a full-time job was not possible and so, I gave myself a few months to work out what I wanted to do in my spare time, not spent on two wheels. I concluded that a part-time job would work well with my cycling endeavours since I could still get in the training hours and, so long as there was flexibility, I could travel to races abroad every month or so.

I was introduced to Jeremy at Insider Pro through a mutual friend and after various discussions and formal interviews, I started working part-time on 5th April 2022. I knew from all the discussions and interviews that the company aligned well with my ambitions, personality, and ways of working. I was fascinated by the prospect of getting stuck into live projects from day one and trying to make an impact for our customers. I initially started part-time and now work four days a week, and due to the flexibility that Insider Pro offers, I can still get out on my bike and be competitive at the highest level of domestic and international racing.

During the last two years, there has been a lot that I have learnt about business, but also a lot about my own ability. I was quite naive before entering the working world, thinking it would take years of experience to be able to start making a tangible difference to customers, but oh boy, was I wrong. An inquisitive mind, attention to detail, and a readiness for learning are three traits that we all express at Insider Pro and have enabled continuous development over the past two years.

Another trait that I feel is particularly pertinent to my work over the last two years is that being wrong is fine, just don’t stop there. This is usually in terms of investigative work that I regularly undertake. Wrong may sound a bit harsh, but as is the nature of investigation, you usually have an inkling as to what the final outcome will be and this can help to shape your avenues of investigation. However, coming to a dead end, or being wrong, in one avenue of investigation is never done in vain, it will only get you closer to the solution. This is not only of short-term benefit, but a long-term one also, since this will enable faster working should you tackle a similar problem in the future.

My learning over the last three years, whilst not exhaustive, can be split into three main categories. Below, I will touch on how I felt about this when I joined, and how I feel about it now.

- People: I must have spoken to a few hundred new people during the last two years, both internally and externally: new colleagues, customers, suppliers, of different backgrounds, ethnicities, in different sectors, and a range of roles etc, etc the list goes on! Speaking to new people is intimidating for anyone; some people are apprehensive when speaking to new people; some people do well to hide it! I’ve developed several methods and mechanisms that enable me to engage quickly and personably with new people, which have been the foundation to develop a strong working relationship.

-

Process: Processes are fundamental to ensuring things are being pushed along in an effective and timely manner. If no process is in place then everyone goes in different directions and things get out of control. Understanding how to operate within this process and having a goal with a clear structure and visible outcome is great for motivation and consistency of working practices. Working practices (such as Jira project management software) were not something I was made aware of at school or University so joining Insider Pro with a receptive mind enabled me to quickly and easily get up to speed with how the team works effectively and optimally day after day.

-

Technology: I was accustomed to using social media and Microsoft platforms before joining Insider Pro, and had experience of GIS platforms, but the application to business was not something I had experienced before. I now use Microsoft Office every day and use various other technology platforms that I did not know existed before. My Microsoft skills have moved from competent to, I think it is fair to say, lightly skilled, but as ever with these platforms, there is still a lot to learn. Furthermore, with the advent of AI and it becoming more and more powerful, being able to harness this power for working practices is an area we will all be keeping a close eye on.

The above points have largely focussed on my own personal development and skills and experiences that I have picked up, but another element of my learning is about business as a whole, so below I ask ‘What are the top things I have learnt during my two years about business?’

-

Speed. Speed of working and agile methodologies are key characteristics to operations, the faster we go, the more work we get through and the more projects we can close out, but…

-

Quality. …Speed of work should never be at the expense of quality of work. We will always act in the best interest of our customers and produce work of the highest quality, aiming to deliver value within 90 days.

-

Asset Building. Asset building for Insider Pro is an ongoing process that involves storing knowledge of how we do certain things. That could be knowing which suppliers are best fit for our customers, or it could be how best to analyse and present particular data sets received from our customers. Therefore, asset building enables a faster cadence of working, knowing that the quality work that was done is never done in vain and can be reused as a kickstart on any new projects in the future that are of a similar nature.

-

Cash flow is critical to business. Quite simply, ensuring a healthy bank balance and a healthy pipeline underpins the ability of a business to operate now and into the future. At Insider Pro we operate an open-book finance model for the business, this creates a sense of motivation and accountability. This means we all know when we need to prioritise work that stimulates short-term cash generation, but also highlights when we are doing well and creates a great sense of team morale.

This blog post gives just a flavour of the things I have learned and experienced over the past two years. Nothing was learned overnight, but picked up from trying, failing, asking and experiencing. I hope that this post offers value to anyone new to the world of work, about to enter the world of work or even, if you have been in work for fifty years. I know that the learning I have picked up in the past 2 years is a drop in the ocean compared to what I will learn in the next two or twenty years, and that excites me.

Topics: Procurement People, Procurement Consultancy, Supply Chain Management, Our Team

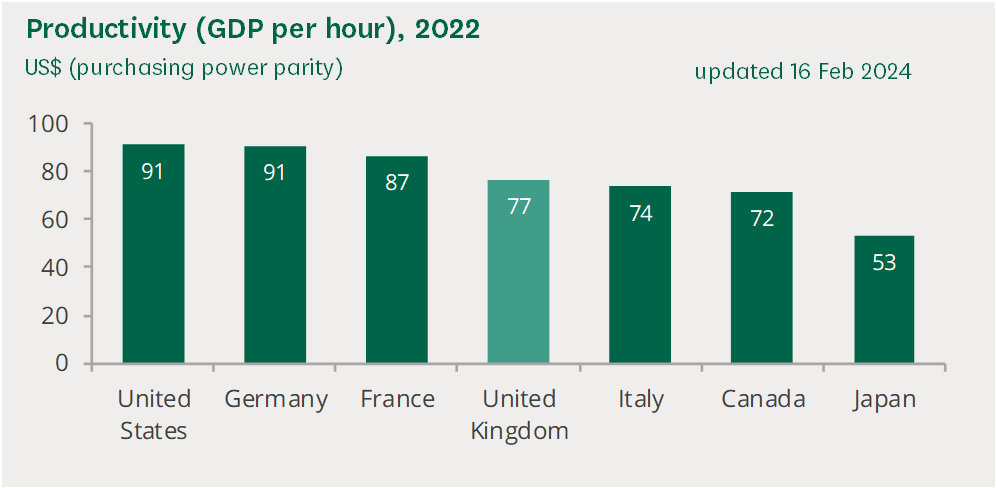

Source: House of Commons Library. Productivity: Key Economic Indicators

Similarly, while government policies on investment incentives or tax relief can provide temporary boosts, they often fail to address underlying systemic issues. For example, significant investment has flowed into digital infrastructure and startup ecosystems, yet productivity growth remains tepid. The reason? These investments are not always aligned with a coherent strategy that addresses the specific needs of businesses or the economy at large. The Government funded UK Productivity Commission set up by the National Institute for Economic and Social research has noted a North/South divide with London performing well but cities in the Midlands and North of England, suffering from poor communications and investment in skills. Lagging sectors include manufacturing, Finance, Insurance and Communications technology.

What else could be drivers? Ross Clark, writing in the Spectator last September had some good ideas. Did the plentiful availability of Eastern European labour replace any incentive for investment in automation? Did the Equality Act of 2010 make it harder to recruit and manage the productivity performance of the workforce? Is the post-pandemic pattern of increased working from home, focus on work-life balance and mental health awareness, also contributing to our challenges in increasing productivity?

True productivity enhancement comes from within the organization. It involves rethinking how tasks are allocated, how teams are structured, and how outcomes are measured. It requires a shift from traditional hierarchies towards more agile, collaborative work environments that empower employees and foster a culture of continuous improvement.

- Reduce the number of meetings your team is involved in - evaluate the necessity of every meeting.

- Invest time in making sure everyone, at all levels, understands the 3 most important things the team will deliver, each quarter.

- Focus half a day a week on getting your team together in one room, to agree who is doing what and what they are not doing. Follow up each week to review activity.

- Use Whatsapp within small groups to communicate quickly - include urgent information, and lots of good news to help motivation and a sense of healthy competition.

- Meanwhile, encourage people to speak to each other 1-2-1, to iron out issues and clarify who is doing what.

In this era of unprecedented change, the UK has the opportunity to redefine its productivity narrative, building on its historical resilience and forward-thinking leadership. The solution lies not in the hands of government alone but within the corridors of businesses across the country.

It is time for a strategic re-think of how we work and grow.

#productivity #efficiency #supplychainmanagement

Topics: Disruptive Procurement, Procurement People, Best Practice, Supply Chain Management

In an ever-changing world that is shaped by global political, environmental, social and technological changes, being aware of how these changes affect your business can feel extremely daunting. Keeping on top of your day-to-day role and responsibilities at work may seem a never-ending task, and then, on top of this, ensuring your business is getting optimal value for money through the products and services that it procures, may not be at the top of your “to do” list.

The world today is exposed to major shifts, be that through environmental degradation fuelled by climate change, or by geopolitical conflicts sending shock waves throughout the world. These events often feel distant to your organisation, especially since the majority of the audience that this article will reach is living in a relatively sheltered and stable society. However, these events can have a significant impact on our society at a scale far beyond just localised impact.

At Insider Pro we are constantly exposed to examples where global dynamics are having an impact on specific sectors. To demonstrate this, we will examine the paper commodity prices and the implications that this has had on the paper packaging sector. To set the scene, this article is being written in early 2024, amidst a war between Russia and Ukraine and a few years after the Coronavirus pandemic. Paper is a commodity, trees have to be cut down, or items have to be recycled to produce the end product.

The very nature of this commodity means that it is exposed to impacts from the following:

Whilst not exhaustive, the aspects highlighted above give a flavour of just how many key elements drive a final commodity price, so understanding how each of these aspects impacts on a commodity price is something that we empower our clients to understand. Continuing with the example of paper pricing, we believe that a holistic understanding of the market and subsequent commodity prices is something that should be a common area of discussion between a packaging supplier and their customers. This could be through a contract term that tracks commodity prices, or just through general discussions aimed at understanding the likely direction of travel in any upcoming price reviews.

Topics: Disruptive Procurement, Best Practice, Procurement Consultancy, Supply Chain Management

Almost every route to higher revenues depends on a reliable and predictable supply chain. Whether you are the CEO, CFO or the Supply Chain Director, knowing that your supply chain weaknesses could suddenly derail this quarter’s numbers, is probably keeping you awake at night! Managing long-term risk, sustainability considerations and the financial impact of an inefficient supply chain can make the difference between business success or failure. Conversely, there are plenty of revenue growth opportunities lurking in your supply chain or operations, hidden by poor data or a resistance to change. Now is the time to expose them and reveal how to scale operations, improve deals with suppliers, leverage overhead and drive out inefficiencies.

In times of high inflation, changes to product specification may identify a great opportunity for cost reduction - a reduction in size, a change to the packaging, a modification of the materials used, or the scope of service provided. All of these (and many more) offer good ways to explore cost reduction and may well reveal acceptable and sensible changes to the design or presentation of an item.

Topics: Supply Chain Management

Insider Pro recently conducted some original research into the pre-pandemic manufacturing sector. We accessed Companies House data for the last 5 years pre-pandemic, for 1500 small and medium sized manufacturing businesses in the UK. The findings show the stark reality about cash and working capital trends, relevant to almost all sectors and organisations, small and large. The insight and learnings can be applied to any business and demonstrate the importance of mapping your supply chain and understanding your key dependencies. Aligning the team around key financial objectives, and making sure they understand how critical it is to manage cash and working capital well will help to build the enterprise value of a healthy, successful business.

Remember, almost every route to higher revenues depends on a reliable and predictable supply chain.

Plan! When forecasting sales, be sure your supply chain can deliver. Big companies have sales and operations planning functions. Smaller ones should bring in some outside help to make sure they are not underestimating the value they can generate from their supply chain.

Source as close to home as you can. Sourcing from low-cost countries may be cheaper but it is often not enough to overcome supply-chain disadvantages, Cost is important but it is not everything.

Make versus Buy – don’t make a component you can source cheaply and reliably. Focus on where you can add value and review service contracts regularly so you are sure you are getting the best price.

Balance where the cash is in the supply chain – don’t pay for goods you’ve not yet received and understand whether your supplier can easily afford to extend credit or not. If a supplier’s cost of capital is higher than yours, you will pay an unnecessary premium for additional credit terms.

Understand your customer. If the cost of capital is very high, the customer will be more motivated to attempt to delay payment.

In conclusion, make sure you pay attention to all these metrics and dials on your metaphorical dashboard. If everything is balanced, revenues will grow but so will profits and cash flow.

Read more about how we came to these conclusions in the UK Manufacturing Barometer – download now at www.insiderpro.co.uk

Topics: Disruptive Procurement, Supply Chain Management, Enterprise Value, Working capital improvement, Cash Flow

Companies aspire to grow for many reasons. To survive, for their employees, for future sale valuation, for an IPO, the incentives are many and varied.

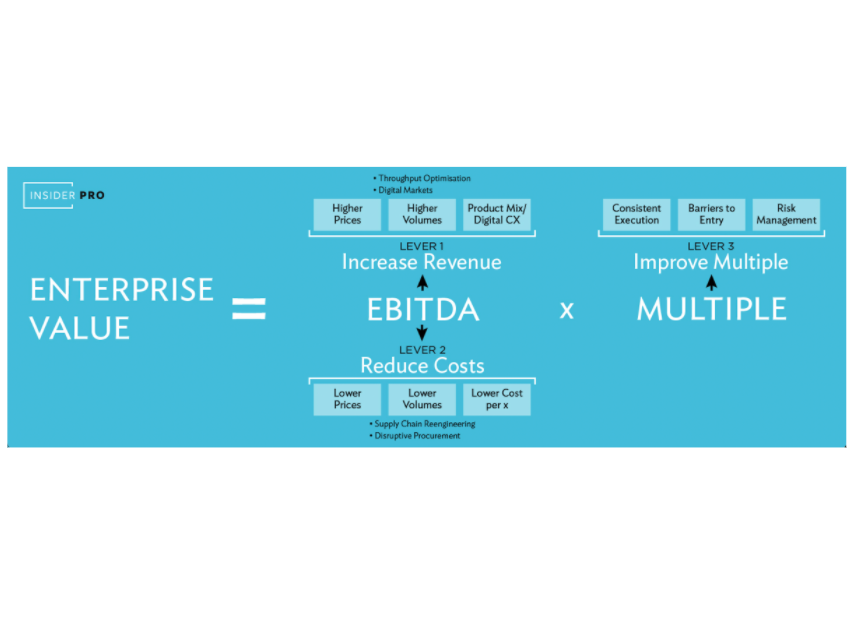

Definitions also vary but at Insider Pro we define Enterprise Value as EBITDA x the MULTIPLE applied.

There are 3 main levers to focus attention on;

- increase revenues,

- reduce costs, and

- improve the multiple to be applied.

Most importantly, you need clarity around how your supply chain and operations will impact these metrics and ultimately your enterprise value.

Revenues – can you set higher prices, increase volumes, improve throughput optimisation and availability, alter your product mix to impact sales?

Costs – through disruptive procurement and working with strategic suppliers, can you reduce cost per X, lower volumes, how can you do things differently and re-engineer the supply chain to reduce the cost of goods and costs of running the business?

Multiple – can you demonstrate consistent execution and stability, and show clear risk management activity? Can you overcome barriers to entry and predict how your competitors will behave? All these will push up the multiple investors are willing to pay.

Why does all this matter? Because if your supply chain and operations teams do not understand the impact of their decisions and actions, they can seriously affect your overall enterprise value. Managing the supply chain is hard and it is critical that all teams, whether Sales, Operations or Procurement are aligned in their understanding and around the company objectives for short, medium and long-term success.

For more real examples of how to impact your supply chain and your enterprise value, download the UK Manufacturing Barometer from www.insiderpro.co.uk now and help to improve understanding of these key metrics.

Topics: Disruptive Procurement, Supply Chain Management, Enterprise Value, Working capital improvement, Cash Flow

There are two routes to growing the value of your business. You can use brute force – just keep cranking up production, run your sales force hot and hope the rest follows, or you can take steps to increase the multiple of profits the business will attract when you come to sell. It’s pretty hard to rely on growth alone. Insider Pro’s Manufacturing Barometer shows that UK manufacturers managed to increase sales by a fifth between 2015 and 2020 before the pandemic – that’s great. But unfortunately, profits haven’t budged. An extra £38bn on the top line hasn’t delivered any additional operating profit. Companies, especially smaller manufacturers, endured a steady margin squeeze that left them less resilient when Covid-19 struck. Higher revenues alone are not enough to build enterprise value.

Of course, the last twelve months have caused a painful hit to industry. Manufacturing has certainly fared better than some parts of the economy like high street retail and hospitality, but even so sales are down around 10% across a broad spread of manufacturing sectors, while profits have approximately halved. Manufacturers are also having to face the messy complications caused by Brexit.

Huge upheaval like this feels awful but it also provides a golden opportunity for a rethink. If you can work both routes at the same time – growing the business and expanding the multiple – then you can really transform the value of your company. There are lots of dials on your metaphorical dashboard that can help you drive higher sales and do so profitably by controlling your costs. If you can grow your profitability 10% but you don’t increase your multiple, then your business is worth 10% more. Not bad. But if you can also get the multiple of profits a buyer would be prepared to pay from 5x EBITDA (operating profit with depreciation added back) to 6x, you’ve just added another 20% right there. Suddenly your business is worth a third more!

Getting your supply chain right goes to the very heart of the issue. These months of crisis have exposed some structural weaknesses in how manufacturers manage their supply chains. A moment of such dislocation makes it easier to reform long-established practices that no longer serve the business well. In any recovery, manufacturers all need to start thinking like growth companies as they come off the back off a ‘low volumes’ year. Scaling up always means stress-testing your supply chain, rather than simply expecting it to grow with you. If your suppliers don’t have capacity, don’t blame them if they can’t keep up, so keep them close and keep an eye on them. Minor problems can quickly balloon as you get bigger.

For example, through the pandemic we have seen how shipping costs can spiral unexpectedly and the availability of product can disappear altogether – supply chains can simply break. Accidents happen too. Indeed, the hullabaloo in the Suez Canal completely severed Asian supply routes in March this year creating all sorts of ripples that took weeks to smooth out. Put simply, a cheap listing price for a component or raw material is irrelevant if getting it to your factory gets pricier, or if you simply can’t get it there at all.

Cash is one of the biggest obstacles for growth, so companies must prioritise cash generation over profit. At Insider Pro we help businesses embed a cash-first culture from boardroom to shop floor. Just adding cash monitoring to weekly reporting can make a surprising difference. Don’t just buffer your business with loads of inventory if you are anxious about disruption to supplies or fulfilment, or because you lack visibility about demand for your products. That’s a cash black hole, right there.

Better forecasting certainly helps, but crucially sourcing supplies closer to home makes a huge difference. For example, China’s low prices are tempting but if you are growing your sales rapidly, such a long supply chain makes the business less resilient and will tie up mountains of working capital. So rather than only aiming for the lowest unit price for a component, the real win may come from sourcing products closer to home and the payoff is more rapid sales growth with less environmental impact and a lower cash-funding requirement.

It might cost a little bit more, but a simpler, shorter supply chain will help you maximise product availability and that means you can take market share from less agile competitors. Show the value of being close to your customer if your competitors are on the other side of the world. That’s a valuable barrier to entry against newcomers.

Similarly, when you innovate you are thinking about adding to the growth side of the enterprise value equation. That’s great. But make sure your engineers have thought about where they will source components. If there is only one supplier and that supplier is far away, you’ve just introduced a major vulnerability into your business and that knocks a chunk off the multiple side of the equation.

Supply chains have consistently dominated the headlines during the last few months. Post-Brexit food shortages in Northern Ireland, pandemic panic-buying, vaccine programmes, disruption of global shipping – the list goes on. Weak supply chains mean risk.

Potential investors pay less for vulnerable businesses. They pay more for those that can execute consistently, are more resilient than their competitors and generate lots of cash in the process. In our experience finance directors underestimate by half the efficiencies they can extract. That’s a big lever to pull in terms of increasing your enterprise value and is especially important in limiting the amount of cash burnt each month.

Over the next couple of years, we are going to see a dramatic rebound in manufacturing that will push sales and profits higher. If companies reengineer their supply chains and source closer to home as part of the recovery then positive multiplier effects can reverberate around the British economy too. Growing sales, expanding margins, building resilience, and doing all this with the most efficient use of scarce capital possible, are the perennial objectives of businesses everywhere that wish to grow their enterprise value. You don’t have to choose route A or route B. You can travel both roads to a higher valuation for your business.

Download the UK Manufacturing Barometer for more insight, using the link below.

Topics: Disruptive Procurement, Supply Chain Management, Enterprise Value, Working capital improvement, Cash Flow