Almost every route to higher revenues depends on a reliable and predictable supply chain. Whether you are the CEO, CFO or the Supply Chain Director, knowing that your supply chain weaknesses could suddenly derail this quarter’s numbers, is probably keeping you awake at night! If 2020/21 has taught us anything it is that managing long term risk, sustainability considerations and the financial impact of an inefficient supply chain, can make the difference between enterprise success and failure.

Many businesses spend up to 70% of the value of their revenue with external third-party suppliers. We see many companies that have overlooked the huge benefits they could achieve by re-assessing and re-mapping their supply chain. Most CFOs underestimate the value by up to 50%.

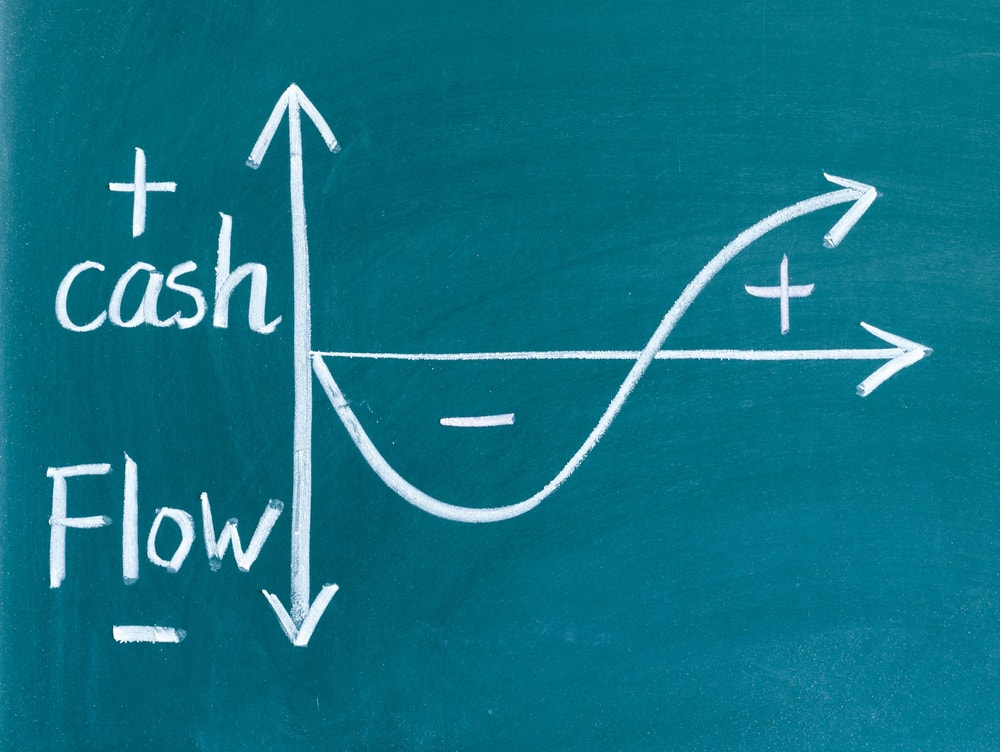

Although lower pricing from China is attractive, if you are growing your sales rapidly, such a long supply chain makes the business less resilient and ties up mountains of working capital which would be better invested in acquiring new customers. If your business model relies on debt funding, then reducing the environmental impact of inbound deliveries by repatriating supply closer to home will help you attract the growing legion of ESG-focused investors. Your supply chain needs a strategic approach; balancing cash, investability and opportunity cost. All of which grow the enterprise value of your business.

Run your supply chain ahead of where you want to be rather than where you are now. Can your suppliers support your production or sales forecasts? Call your key suppliers and ask them what business they expect to do with you over the next month/quarter/year. You might be running your own inventory effectively or managing payment terms superbly, but strains elsewhere in the supply chain will usually end up costing you one way or another. Not solving these problems is like driving a car with the handbrake on and too much luggage in the boot.

Have clarity about what can be done to improve the business. Set clear objectives and organise the supply chain around them. Be able to predict what your competitors or suppliers will do if you take a certain decision. Build barriers to entry wherever possible.

Building enterprise value depends on fine-tuning all the dials on your metaphorical dashboard. Doing this right doesn’t just add incremental value but is truly transformative.

For some good examples download the UK Manufacturing Barometer now from www.insiderpro.co.uk