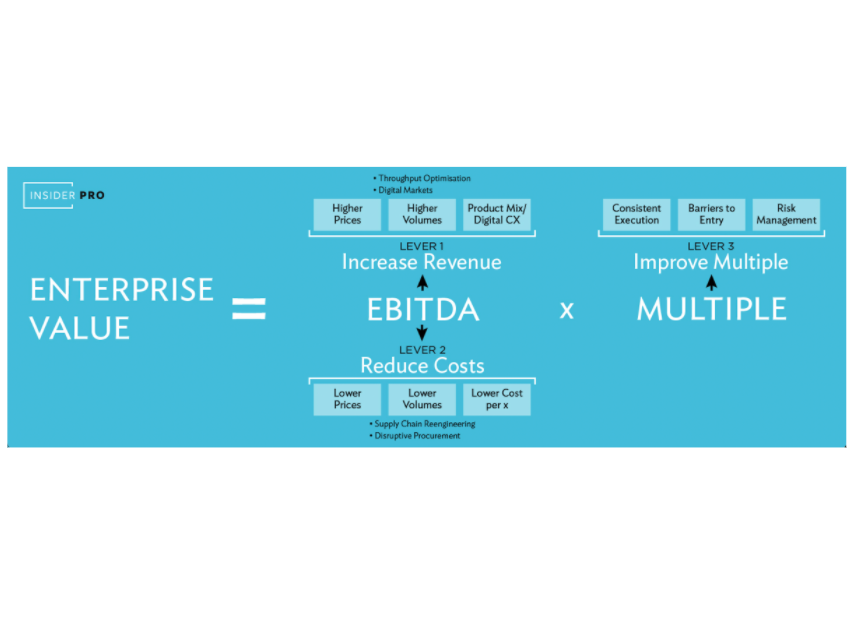

Insider Pro recently conducted some original research into the pre-pandemic manufacturing sector. We accessed Companies House data for the last 5 years pre-pandemic, for 1500 small and medium sized manufacturing businesses in the UK. The findings show the stark reality about cash and working capital trends, relevant to almost all sectors and organisations, small and large. The insight and learnings can be applied to any business and demonstrate the importance of mapping your supply chain and understanding your key dependencies. Aligning the team around key financial objectives, and making sure they understand how critical it is to manage cash and working capital well will help to build the enterprise value of a healthy, successful business.

Remember, almost every route to higher revenues depends on a reliable and predictable supply chain.

Plan! When forecasting sales, be sure your supply chain can deliver. Big companies have sales and operations planning functions. Smaller ones should bring in some outside help to make sure they are not underestimating the value they can generate from their supply chain.

Source as close to home as you can. Sourcing from low-cost countries may be cheaper but it is often not enough to overcome supply-chain disadvantages, Cost is important but it is not everything.

Make versus Buy – don’t make a component you can source cheaply and reliably. Focus on where you can add value and review service contracts regularly so you are sure you are getting the best price.

Balance where the cash is in the supply chain – don’t pay for goods you’ve not yet received and understand whether your supplier can easily afford to extend credit or not. If a supplier’s cost of capital is higher than yours, you will pay an unnecessary premium for additional credit terms.

Understand your customer. If the cost of capital is very high, the customer will be more motivated to attempt to delay payment.

In conclusion, make sure you pay attention to all these metrics and dials on your metaphorical dashboard. If everything is balanced, revenues will grow but so will profits and cash flow.

Read more about how we came to these conclusions in the UK Manufacturing Barometer – download now at www.insiderpro.co.uk