Every business trying to grow their enterprise value needs to grow sales, increase margins but, all whilst using scarce working capital efficiently.

Sustainable growth is only possible if you have a firm handle on cash. Running out of cash can sink an otherwise successful business.

Working capital levers include managing inventory levels, customer debt and the money you owe your suppliers. It is important to get working capital as low as possible and make sure it does not grow faster than sales.

In our recent original research in the UK Manufacturing Barometer, which analyses the UK manufacturing sector, we can see that despite companies enjoying solid revenue growth over the last 5 years, those sales did not translate into higher profits. We concluded there are 3 main cash-control challenges which are shown below in an excerpt from the report.

Challenge 1 – getting paid

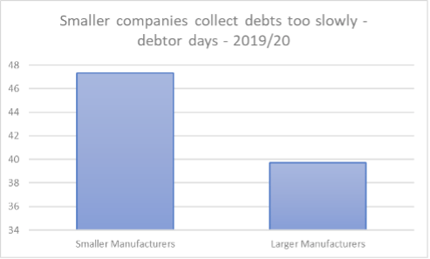

First there is the collection of customer debts. Companies must do this as swiftly as possible. During the interval between supplying goods to customers and collecting the cash, the manufacturer is effectively financing his customer, allowing him to sell on the goods or add further value before actually paying for them. Manufacturers have managed these trade debtors reasonably well, especially over the last three years, with the value of unpaid bills rising more slowly than sales. In 2019/20 companies collected all their debts in an average of 43.6 days, down from 46.0 days in 2016/17. Most sectors have improved collections, as have larger and smaller manufacturers, but bigger players are consistently significantly more effective than their smaller counterparts. Those with sales under £200m give their customers an extra week to pay on average (47.3 days compared to 39.7 days for larger producers). For almost the same value of sales in 2019/20 the smaller companies in our sample provided their customers with £2.6bn more credit than bigger firms. On average customers owed each smaller company £12.2m in 2019/20 at any given moment, compared to outstanding invoices of £38.5m for larger firms.

Challenge 2 – staving off creditors

The second challenge is to delay paying suppliers as long as possible. A manufacturer must strive to complete as much of the production and sales process as possible before he has to pay his supplier. In other words, suppliers are helping finance a producer’s working capital. On this measure companies have not done as well. In 2019/20, they paid their trade creditors 1.4 days more quickly than in 2016/17, with almost all sectors unable to extend their credit terms. This created an unnecessary additional £652m working capital need (ie after adjusting for higher sales). What’s more, two thirds of this burden fell on smaller manufacturers. Suppliers have clearly successfully pressured manufacturers to pay their bills more quickly.

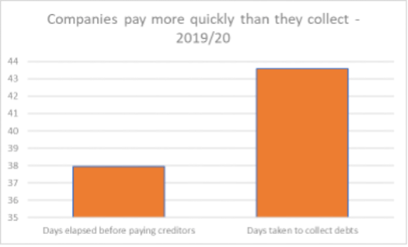

Overall, manufacturers are subject to tighter payment terms from their suppliers than they extract from their customers, paying their bills on average almost six days more quickly than their customers settle their accounts. The average company in our sample was owed £5.6m more by customers than it owed suppliers at any given moment in 2019/20, up from £4.9m in 2015/16. Even if debts were collected and creditors paid at the same time, the difference between the two would always grow if sales are increasing, because a manufacturer is adding value in his production process – selling products for more than the cost of raw materials. This means constant vigilance is essential to keep the working capital need to a minimum.

Challenge 3 – stock control is crucial

The final challenge relates to inventory (also called stock) management. This can be especially difficult. Manufacturers need enough raw materials to keep production going, but having too much not only adds cost in terms of warehousing and can lead to spoilage in some industries, but this also absorbs huge amounts of cash. Equally companies do not want capital tied up in goods mid-production, nor in finished goods sitting waiting for customers to buy them.

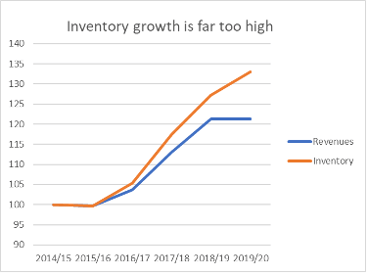

Unfortunately, producers have not managed inventories well in recent years, seeing them rise consistently faster than sales. In 2019/20, they held inventories worth two months (61 days) of production, an increase of four days since 2016/17 and almost a week over the last five years. Inventories have swollen by £5.9bn in three years – two thirds of this can be explained by higher sales, but the rest, £1.9bn, is down to less efficient inventory management. Chemicals and building materials firms have seen disproportionately large increases in inventories, but every sector except textiles is holding more stock than can be justified by sales growth. Smaller manufacturers have allowed the situation to deteriorate more than their larger counterparts, accounting for three fifths of the increase. The average manufacturer in our sample held £19.3m of stock at any given moment in 2019/20, £4.2m more than in 2016/17, an increase of 28%.