Most companies I meet have problems with data. Why? There is often no one person sponsoring the need to get on top of the issue, no one making it a central focus area and helping the business to believe it can be sorted. Culturally, it’s about ownership and accountability but someone needs to lead the revolution. The problems are rooted in:

- legacy ERP systems that do not talk to each other

- poor processes meaning that the most relevant data is not captured accurately, leading to quality issues

- outdated technology meaning they do not have access to latest automation or visualisation tools

Why does it matter? Poor data management often results in poor alignment across teams, different understandings, opinions not based on facts, no single version of the truth, no evidence-based decision making. Companies underestimate the cost of poor data management in terms of lost opportunities, re-work, brand and regulatory damage. And moreover, forecasting and predicting future requirements become very difficult without a strong, reliable, source of data.

What can you do about it?

- Most importantly, decide what insights you need to run the business and to meet your strategic and day-to-day decisions.

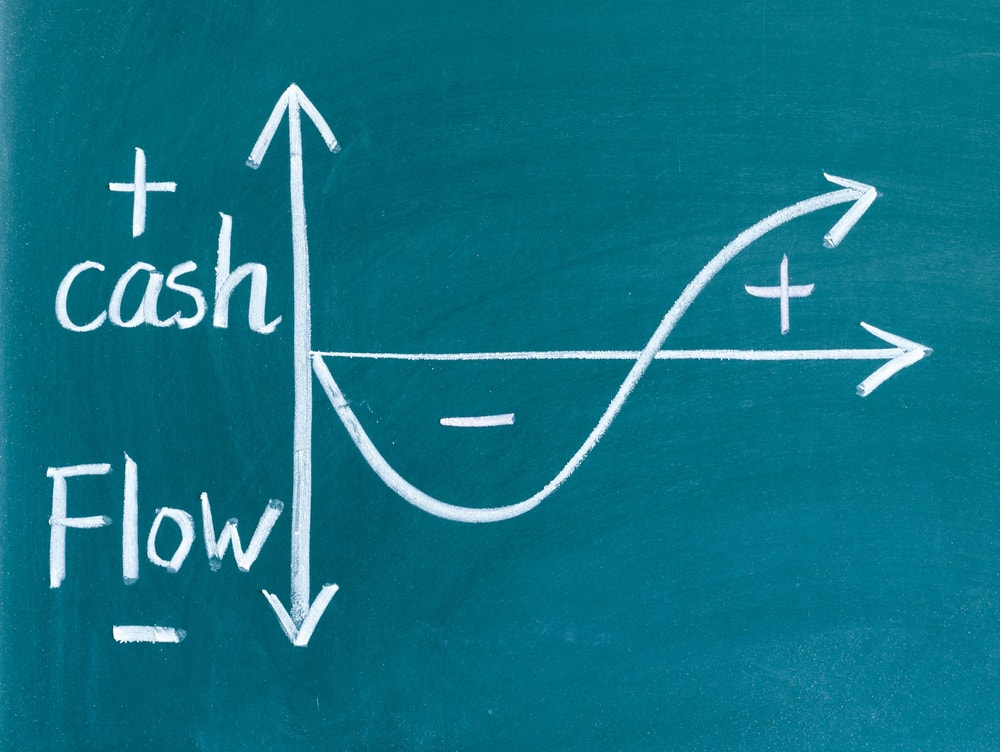

- Improve Financial literacy of your S & OP teams – help them to see the impact that their activities on the overall company performance. Make sure that everything they do is linked to the overall Company financial objectives and that they have the data to see the effect of their activities.

- Support investment in new, accessible analytical tools as well as training and development which will help to “democratize” data for all. Simplify self-serve analytics.

Insider Pro’s recent research in the UK Manufacturing Barometer revealed interesting trends by gathering data on 1500 companies over the past 5 years from Companies House. Simple visualisation tools enabled us to see the wood from the trees and understand the trends and patterns that had been affecting the sector. Managing working capital is at the heart of business success and you can only succeed if you have the data to see what is happening.

For some good examples of supply chain data revealed the challenges, download the UK Manufacturing Barometer from www.insiderpro.co.uk by using the link below.