In a previous blog post I wrote about the importance of staying in control of your contracts. This post serves to illustrate a recent example of this where a customer was mis-charged for eight years. In today’s fast-paced business world, companies with large workforces, particularly those in clinical environments, rely heavily on efficient, outsourced services to maintain operations. When those services falter, the impact can be widespread, affecting recruitment, staff welfare, and even company financial performance. Third parties are as critical to the supply chain as your internal resource. Recently, a 6,000-employee organisation, faced such a challenge with its outsourced Occupational Health (OH) services. This blog post demonstrates how, with the help of Insider Pro, the company turned things around, reclaiming significant overcharges and improving service delivery without increasing costs.

Navigating Occupational Health Challenges: How Insider Pro helped one company transform its service delivery realising an immediate benefit of £100,000+ and ongoing savings of 25%+

Topics: Case Studies, Occupational Health

The Vital Role of Supply Chain and Operations: Lessons from a leading UK Firm.

A couple of weeks ago I wrote about “Looking under the hood”. Here is a great example of what I mean. At Insider Pro, we see the pattern time and time again - long-term, legacy contracts that were initially great value for the customer but, over time, the supplier has managed to push through incremental price increases, or adjusted clauses that are not in the customers' favour.

Topics: Supply Chain Management, Contracts

Trash or rubbish, or waste, is something we all produce daily, and other than putting it into a nearby bin or putting the bins out once a week, you probably don’t think much about it. In this blog I will be talking rubbish… literally, not metaphorically.

The waste landscape is ever changing but its importance to society and business is becoming increasingly pertinent. As the population increases and individuals use and consume more and more products on a daily basis, the demand for waste disposal increases. Society is also becoming increasingly environmentally conscious, so the ability to just chuck everything to landfill is no longer an option, and with the use of rarer substances that require specific disposal methods, there is a requirement for robust waste solutions.

What types of waste are there?

There are eight types of waste, these are: (Click to slide through)

Where does waste go?

Depending on the type of waste being collected, it could go through several potential destinations and processes:

Topics: Disruptive Procurement, Best Practice, Procurement Consultancy, Case Studies

This blog post provides a very different insight from the usual blog posts we produce at Insider Pro, rather this post is more personal about my two years at the company. Working at Insider Pro was my first ‘proper’ job post-university and so as you can imagine, I have experienced a plethora of things in this time.

I finished University in September 2021 and was presented with the opportunity to join a professional cycling team. Cycling has been a passion of mine from a young age and I knew this was an opportunity I should not turn down. Accepting this meant that a full-time job was not possible and so, I gave myself a few months to work out what I wanted to do in my spare time, not spent on two wheels. I concluded that a part-time job would work well with my cycling endeavours since I could still get in the training hours and, so long as there was flexibility, I could travel to races abroad every month or so.

I was introduced to Jeremy at Insider Pro through a mutual friend and after various discussions and formal interviews, I started working part-time on 5th April 2022. I knew from all the discussions and interviews that the company aligned well with my ambitions, personality, and ways of working. I was fascinated by the prospect of getting stuck into live projects from day one and trying to make an impact for our customers. I initially started part-time and now work four days a week, and due to the flexibility that Insider Pro offers, I can still get out on my bike and be competitive at the highest level of domestic and international racing.

During the last two years, there has been a lot that I have learnt about business, but also a lot about my own ability. I was quite naive before entering the working world, thinking it would take years of experience to be able to start making a tangible difference to customers, but oh boy, was I wrong. An inquisitive mind, attention to detail, and a readiness for learning are three traits that we all express at Insider Pro and have enabled continuous development over the past two years.

Another trait that I feel is particularly pertinent to my work over the last two years is that being wrong is fine, just don’t stop there. This is usually in terms of investigative work that I regularly undertake. Wrong may sound a bit harsh, but as is the nature of investigation, you usually have an inkling as to what the final outcome will be and this can help to shape your avenues of investigation. However, coming to a dead end, or being wrong, in one avenue of investigation is never done in vain, it will only get you closer to the solution. This is not only of short-term benefit, but a long-term one also, since this will enable faster working should you tackle a similar problem in the future.

My learning over the last three years, whilst not exhaustive, can be split into three main categories. Below, I will touch on how I felt about this when I joined, and how I feel about it now.

- People: I must have spoken to a few hundred new people during the last two years, both internally and externally: new colleagues, customers, suppliers, of different backgrounds, ethnicities, in different sectors, and a range of roles etc, etc the list goes on! Speaking to new people is intimidating for anyone; some people are apprehensive when speaking to new people; some people do well to hide it! I’ve developed several methods and mechanisms that enable me to engage quickly and personably with new people, which have been the foundation to develop a strong working relationship.

-

Process: Processes are fundamental to ensuring things are being pushed along in an effective and timely manner. If no process is in place then everyone goes in different directions and things get out of control. Understanding how to operate within this process and having a goal with a clear structure and visible outcome is great for motivation and consistency of working practices. Working practices (such as Jira project management software) were not something I was made aware of at school or University so joining Insider Pro with a receptive mind enabled me to quickly and easily get up to speed with how the team works effectively and optimally day after day.

-

Technology: I was accustomed to using social media and Microsoft platforms before joining Insider Pro, and had experience of GIS platforms, but the application to business was not something I had experienced before. I now use Microsoft Office every day and use various other technology platforms that I did not know existed before. My Microsoft skills have moved from competent to, I think it is fair to say, lightly skilled, but as ever with these platforms, there is still a lot to learn. Furthermore, with the advent of AI and it becoming more and more powerful, being able to harness this power for working practices is an area we will all be keeping a close eye on.

The above points have largely focussed on my own personal development and skills and experiences that I have picked up, but another element of my learning is about business as a whole, so below I ask ‘What are the top things I have learnt during my two years about business?’

-

Speed. Speed of working and agile methodologies are key characteristics to operations, the faster we go, the more work we get through and the more projects we can close out, but…

-

Quality. …Speed of work should never be at the expense of quality of work. We will always act in the best interest of our customers and produce work of the highest quality, aiming to deliver value within 90 days.

-

Asset Building. Asset building for Insider Pro is an ongoing process that involves storing knowledge of how we do certain things. That could be knowing which suppliers are best fit for our customers, or it could be how best to analyse and present particular data sets received from our customers. Therefore, asset building enables a faster cadence of working, knowing that the quality work that was done is never done in vain and can be reused as a kickstart on any new projects in the future that are of a similar nature.

-

Cash flow is critical to business. Quite simply, ensuring a healthy bank balance and a healthy pipeline underpins the ability of a business to operate now and into the future. At Insider Pro we operate an open-book finance model for the business, this creates a sense of motivation and accountability. This means we all know when we need to prioritise work that stimulates short-term cash generation, but also highlights when we are doing well and creates a great sense of team morale.

This blog post gives just a flavour of the things I have learned and experienced over the past two years. Nothing was learned overnight, but picked up from trying, failing, asking and experiencing. I hope that this post offers value to anyone new to the world of work, about to enter the world of work or even, if you have been in work for fifty years. I know that the learning I have picked up in the past 2 years is a drop in the ocean compared to what I will learn in the next two or twenty years, and that excites me.

Topics: Procurement People, Procurement Consultancy, Supply Chain Management, Our Team

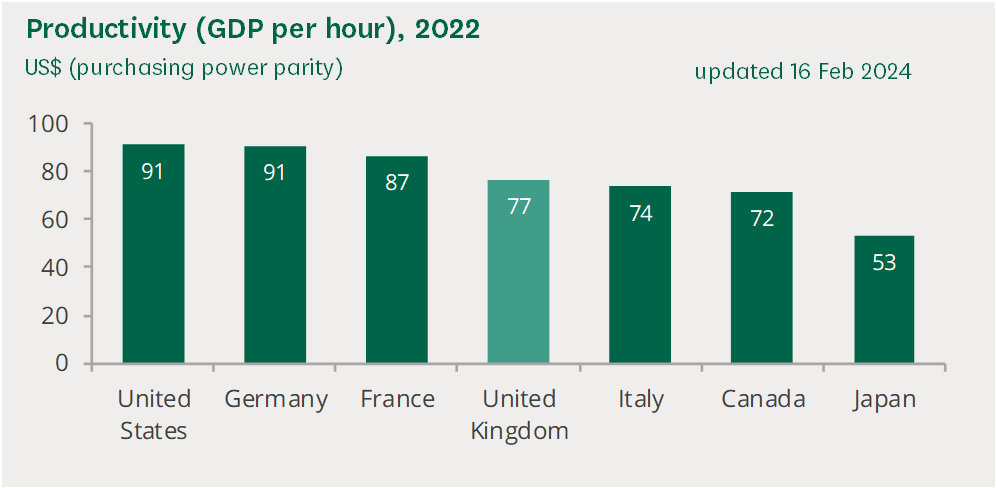

Source: House of Commons Library. Productivity: Key Economic Indicators

Similarly, while government policies on investment incentives or tax relief can provide temporary boosts, they often fail to address underlying systemic issues. For example, significant investment has flowed into digital infrastructure and startup ecosystems, yet productivity growth remains tepid. The reason? These investments are not always aligned with a coherent strategy that addresses the specific needs of businesses or the economy at large. The Government funded UK Productivity Commission set up by the National Institute for Economic and Social research has noted a North/South divide with London performing well but cities in the Midlands and North of England, suffering from poor communications and investment in skills. Lagging sectors include manufacturing, Finance, Insurance and Communications technology.

What else could be drivers? Ross Clark, writing in the Spectator last September had some good ideas. Did the plentiful availability of Eastern European labour replace any incentive for investment in automation? Did the Equality Act of 2010 make it harder to recruit and manage the productivity performance of the workforce? Is the post-pandemic pattern of increased working from home, focus on work-life balance and mental health awareness, also contributing to our challenges in increasing productivity?

True productivity enhancement comes from within the organization. It involves rethinking how tasks are allocated, how teams are structured, and how outcomes are measured. It requires a shift from traditional hierarchies towards more agile, collaborative work environments that empower employees and foster a culture of continuous improvement.

- Reduce the number of meetings your team is involved in - evaluate the necessity of every meeting.

- Invest time in making sure everyone, at all levels, understands the 3 most important things the team will deliver, each quarter.

- Focus half a day a week on getting your team together in one room, to agree who is doing what and what they are not doing. Follow up each week to review activity.

- Use Whatsapp within small groups to communicate quickly - include urgent information, and lots of good news to help motivation and a sense of healthy competition.

- Meanwhile, encourage people to speak to each other 1-2-1, to iron out issues and clarify who is doing what.

In this era of unprecedented change, the UK has the opportunity to redefine its productivity narrative, building on its historical resilience and forward-thinking leadership. The solution lies not in the hands of government alone but within the corridors of businesses across the country.

It is time for a strategic re-think of how we work and grow.

#productivity #efficiency #supplychainmanagement

Topics: Disruptive Procurement, Procurement People, Best Practice, Supply Chain Management

In an ever-changing world that is shaped by global political, environmental, social and technological changes, being aware of how these changes affect your business can feel extremely daunting. Keeping on top of your day-to-day role and responsibilities at work may seem a never-ending task, and then, on top of this, ensuring your business is getting optimal value for money through the products and services that it procures, may not be at the top of your “to do” list.

The world today is exposed to major shifts, be that through environmental degradation fuelled by climate change, or by geopolitical conflicts sending shock waves throughout the world. These events often feel distant to your organisation, especially since the majority of the audience that this article will reach is living in a relatively sheltered and stable society. However, these events can have a significant impact on our society at a scale far beyond just localised impact.

At Insider Pro we are constantly exposed to examples where global dynamics are having an impact on specific sectors. To demonstrate this, we will examine the paper commodity prices and the implications that this has had on the paper packaging sector. To set the scene, this article is being written in early 2024, amidst a war between Russia and Ukraine and a few years after the Coronavirus pandemic. Paper is a commodity, trees have to be cut down, or items have to be recycled to produce the end product.

The very nature of this commodity means that it is exposed to impacts from the following:

Whilst not exhaustive, the aspects highlighted above give a flavour of just how many key elements drive a final commodity price, so understanding how each of these aspects impacts on a commodity price is something that we empower our clients to understand. Continuing with the example of paper pricing, we believe that a holistic understanding of the market and subsequent commodity prices is something that should be a common area of discussion between a packaging supplier and their customers. This could be through a contract term that tracks commodity prices, or just through general discussions aimed at understanding the likely direction of travel in any upcoming price reviews.

Topics: Disruptive Procurement, Best Practice, Procurement Consultancy, Supply Chain Management

It’s no secret that speed is a fundamental characteristic of many successful businesses, be that fast food chains delivering food, or a service-based company delivering value and quick results through efficiencies or cost savings. Speed is ultimately a result of delivering a product or service in an efficient and timely manner.

Whilst there are almost endless things that can increase the speed of a business, this blog focuses on one of the key aspects that our team at Insider Pro takes time to commit to all of our customers, relationship building. By building strong relationships, we ultimately gain the trust of those individuals and this enables a far more successful and faster-paced working relationship.

A relationship is not formed with a company, but with those individuals who work for that company. All of these individuals have different personalities and ways of going about their work. Taking the time to understand how every individual operates is key to the success of a project. This could be as simple as understanding how best to communicate with an individual. Are they someone who prefers written communication to enable more time to digest the information? Or do they prefer a simple phone call or video call as a means to relay information? Tailoring your ways of working to deliver an optimal strategy for a customer, offers benefits to both parties.

Strong relationships with customers can be developed through the following key themes:

-

Clear Communication - Clear communication is vital for trust because it ensures customers understand what to expect, what our ways of working are, and any potential issues. When expectations are clear and met, trust naturally grows.

-

Shared Values - Having shared values creates a sense of alignment between us and our customers. This creates a foundation of mutual understanding and respect, which enables increased confidence in our decision-making and actions taken on our customers' behalf.

-

Shared Goals and Objectives - Mutual success is a common characteristic that enhances the relationship between Insider Pro and our customers. When both parties are working towards common goals, such as hitting specific milestones, this fosters collaboration and transparency.

-

Confidence to challenge each other constructively - The ability to challenge each other within a customer relationship is something that requires much consideration. Ensuring that the challenge is made in a way that is constructive and makes the customer feel empowered, is critical. Challenging a customer with accompanying data to support your challenge can prove particularly impactful. At Insider Pro we are sometimes met with an initial reluctance to change, but if challenged with data or evidence that clearly supports a change, this helps to empower our customers to act upon our proposals. This is always a two-way relationship, and having a customer that challenges our ways of thinking too, can enable a deeper dive into a specific area.

When the four themes discussed above are implemented within a structured framework, the results will speak for themselves. Great results are a product of great relationships, and our team at Insider Pro has experienced this first-hand!

Topics: Disruptive Procurement, Procurement People, Procurement Consultancy, Our Team

We have heard so much recently about AI and the impact it will have on every origanisation. And yet, working with small and mid-cap businesses, we constantly see that they are not able to access the data generated by the organisation and are not generating relevant and valuable insights.

Topics: Data Integrity

Almost every route to higher revenues depends on a reliable and predictable supply chain. Whether you are the CEO, CFO or the Supply Chain Director, knowing that your supply chain weaknesses could suddenly derail this quarter’s numbers, is probably keeping you awake at night! Managing long-term risk, sustainability considerations and the financial impact of an inefficient supply chain can make the difference between business success or failure. Conversely, there are plenty of revenue growth opportunities lurking in your supply chain or operations, hidden by poor data or a resistance to change. Now is the time to expose them and reveal how to scale operations, improve deals with suppliers, leverage overhead and drive out inefficiencies.