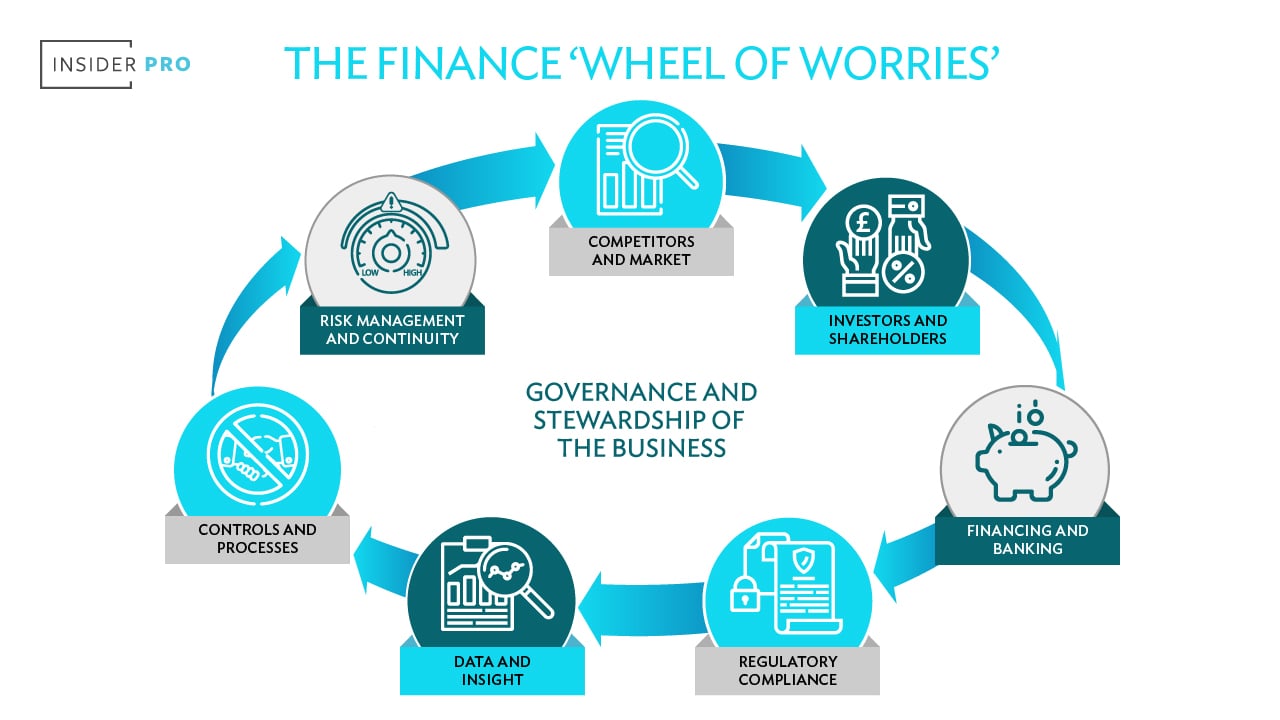

As the key person responsible for governance and stewardship of the business, most CFOs are losing some sleep in these troubled times. There are plenty of balls to juggle and people to answer to, but whatever the pressures, a clear focus on Enterprise Value can provide an immediate improvement in cash flow and set the business up for future growth.

Typical day to day pressures faced include:

- Keeping track of what is going on in the sector, knowing what the competitors are planning, assessing the impact of any political or regulatory change makes for a full-time job. Information comes from multiple sources and means accurate evaluation is crucial, based on solid facts and critical analysis.

- Meanwhile, investors and shareholders need re-assurance and frequent updates. Strong communication is time consuming but essential for confidence.

- Securing funding from the right source, planning future requirements and balancing the risk profile in uncertain times requires a cool head and negotiation staying power.

- New regulatory environments can be complicated and create uncertainty. Matters such as IFRS16, GDPR and cyber security frequently bring new compliance pressures from auditors and oversight bodies.

- Forecasting the future is a tough job. Forward planning accurately is a huge challenge requiring robust data for the insight it can offer. Yet data is often lacking, difficult to access or of poor quality. In our survey, 67% of people thought that poor data and the resulting lack of insight, was their biggest blocker to improvement. Questions about the impact of artificial intelligence abound, yet legacy technology obstructs and frustrates.

- Knowing strong controls and processes are in place can re-assure. But fear of fraud, poor contracting or simply people going off-process is a constant concern.

- Visibility across the business is often lacking, with departments or functions too often working in silos. The CFO needs a joined-up approach with clearly aligned objectives for all.

So, what’s the answer?

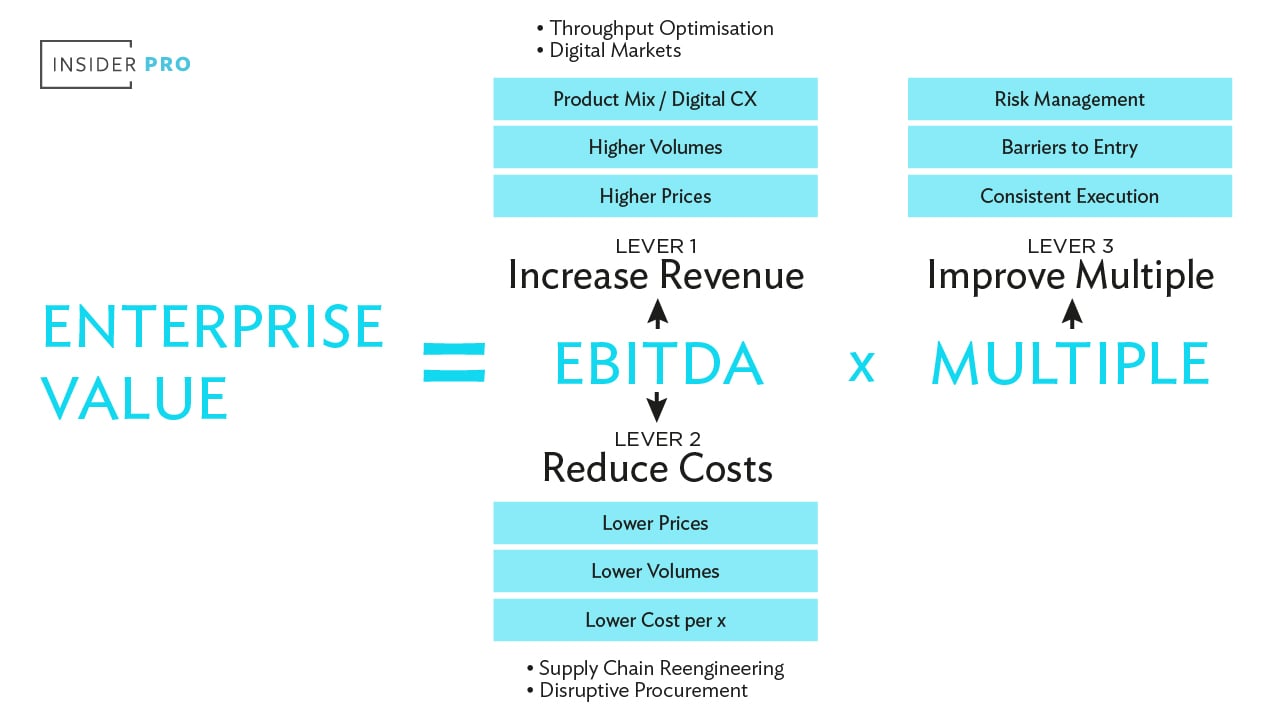

Getting the senior team across the business to focus on the Enterprise Value equation will accelerate improvement on all the business's key metrics, most notably cash flow. Helping all concerned to understand that increasing EBITDA and the multiple applied, using 3 simple levers, will focus their minds and deliver results fast.

Take action now to ensure:

- Everyone in the team understands the Enterprise Value equation.

- Make sure all functional leaders are super clear on how they and their teams can directly affect enterprise value.

- Agree number-based objectives and accountabilities for each person with each linked to one of: - P&L, Balance Sheet or Memorandum of Information

- Create 90 day/quarterly plans with Enterprise Value based SMART objectives

- Measure individual progress weekly

- Share success and re-plan every 90 days whilst all the time tracking Enterprise Value growth!

As CFO, stop the wheel of worries in its tracks and shift the focus of the entire team onto Enterprise Value growth. By making sure every team member can see how their actions directly impact Enterprise Value and giving the whole team that visibility, you will surely sleep better at night.